Posts Tagged ‘Gift Planning’

Using assets under management for Bible translation

By Steve Davis, Director of Gift Planning, Wycliffe Foundation

By Steve Davis, Director of Gift Planning, Wycliffe Foundation

Is your stock still appreciating? What about that rental property that you own and manage for God? These are just two of the many assets under management that are worth more today than when they were purchased. And with the recent upturn in the market, these assets are probably worth more than you might think.

However, most people think that they have to hang on to these assets based on the belief that selling them they would incur cost-prohibitive capital gains taxes. As a result, God’s stewards do not consider these resources as sources for giving.

But there is an opportunity to increase your current impact on the work of Bible translation while blessing your children and grandchildren. By using an asset such as marketable securities, you can actually contribute more than you would by using cash. The concept is to use an asset that is worth more today than it was when you acquired it to establish a donor-advised fund (DAF).

What is a donor-advised fund? A donor-advised fund is a charitable giving vehicle administered by Wycliffe Foundation and created for the purpose of managing Kingdom-impact donations on behalf of you and your family.

Here’s how a DAF works:

- You or your private foundation make an irrevocable, taxdeductible

- contribution to Wycliffe Foundation

- Wycliffe Foundation liquidates the assets and invests the proceeds

- You advise the Foundation on what qualified organizations will

- receive grants

- The Foundation completes due diligence and disperses the funds

- You can name a successor representative to make grants after

- your death

- You maximize God’s assets and simplify your giving

Many assets can fund this powerful giving tool, including underused assets such as marketable securities, certificates of deposit, cash, real estate and business interests that have appreciated in value.

Partners who initiate a DAF enjoy tax-advantaged giving by receiving an immediate tax deduction and eliminating capital gains taxes on the assets contributed to the fund. DAFs essentially act like a family foundation without the annual tax reporting and paperwork while maximizing giving opportunities to Bible translation and the Wycliffe family of organizations.

So what assets do you have under management that God could use to fund such a giving vehicle? To learn more, visit http://wycliffefoundation.org/daf.

At a glance: Donor-advised funds

- Fund assets are invested so that growth and/or annual net income may be available for distribution

- Make grant recommendations at any time, including anonymous gifts

- Name a successor adviser to continue making recommendations for up to 20 years beyond the lifetime of the initial trust holder

- Maximize tax savings

- Benefit from the experience and expertise of the Wycliffe Foundation team

Giving Through a DAF: A family affair

Many families use DAFs as their family giving fund. Children and grandchildren are assigned a certain dollar amount to “manage” from the fund. After conducting their own research, the family gathers together and recommends where those dollars can make the most impact. By involving additional family members, supporters can pass along charitable and spiritual values to loved ones who are also actively involved in the giving process.

Leading the way to finish the task in this generation

Looking for a way to make a greater Kingdom impact, especially through the work of Bible translation? You may not think you can, because:

• You have non-cash assets,

• You desire to pass these assets to family and/or

• You would pay capital gains and gift tax.

What if you could use these assets, transfer more to your children tax-free and still impact the Kingdom? A charitable lead trust (CLT) can do this, and it’s the right tool for this time.

Your opportunity to effectively transfer assets to the next generation has never been better. Rates that predict how much assets will grow in the trust are at an all-time low, making this a timely and wise decision. Many assets, such as securities and businesses, are severely depressed, and it’s likely that they’ll appreciate at a rate well beyond this in the coming years. The combination of low rates and depressed asset values provides a rare opportunity to maximize the use of a CLT.

How does a CLT work?

You transfer assets such as cash, real estate, stocks or business interests to a trust for a set number of years. Each year, payments are made as a fixed percentage from the trust to the ministries of your choice. For even more flexibility, you can set up a Wycliffe Donor Advised Fund, and the trust payments can be made to your DAF. From here, you recommend grants to your favorite Kingdom causes, such as Bible translation.

When the trust expires, the remainder passes to your family. Once the assets are contributed to the CLT, they are immediately removed from your taxable estate, and all assets—including future appreciation—pass to your children and bypass the estate tax.

Who can utilize this? CLTs are the perfect tool for stewards who desire to exercise wise Biblical stewardship, produce greater Kingdom impact and give resources tax-free to family and loved ones.

What are the benefits of a CLT ?

• Trust receives annual charitable deduction for amounts paid to charity,

• Appreciation in value is not included in your estate,

• Assets required during lifetime can be committed to ministry at death,

• Additional Kingdom impact, and

• Assets passed to family with reduced or zero tax.

You see, there is a solution to the desire to impact the work of Bible translation and provide for your family. Consider a CLT and lead the way to finishing the task of Bible translation in this generation.

Neither the author, the publisher, nor this organization is engaged in rendering legal or tax advisory service. For advice or assistance in specific cases, the services of an attorney or other professional adviser should be obtained. The purpose of this publication is to provide general gift planning information. Watch for tax revisions. State laws govern wills, trusts, and charitable gifts made in a contractual agreement. Advice from legal counsel should be sought when considering these types of gifts. © Copyright Wycliffe Foundation

Funding the future: The gift that keeps on giving

By Steve Davis, Director of Gift Planning, Wycliffe Foundation

We are here to serve each of you in discovering and implementing God’s plan of stewardship for what He has entrusted to you. As a result, we don’t ask people to make current gifts. However, one of the things that we frequently hear from God’s stewards is “I wish I could give more to the work of Bible translation,” or “I wish my gift were larger.” I’d venture to say that most of you would be interested in finding a way that you could do that today and in the future as well.

Additionally, one of the other concerns of the missionaries that you support is “Who will replace the resources provided by my supporters when they go home to be with the Lord?” These two issues are at the heart of the principle of laying up treasure in heaven. Let me show you a way that you can solve both of these problems by funding the future using a gift that keeps on giving. This concept will also enable you to make your largest gift ever to impact the future of Bible translation.

This gift is called a “bequest endowment,” and here’s how it works: As part of your planning, you include a Wycliffe organization or missionaries serving in Bible translation in your will or trust in the form of a bequest. A bequest can be completed several ways. For example, you can name one of the Wycliffe affiliates to receive a certain percentage of your estate. You can also gift a specific property, or you can designate that all or a portion of “what’s left” go to impact the work of Bible translation. Any of these will allow you to use these assets while you’re alive, provide for your family and impact the work of Bible translation in a significant way. In essence, it allows you to make the largest gift you’ve ever made.

In making this decision, the question then becomes “How much should I leave?” This is where the “bequest endowment” comes into the picture. This will enable you to continue supporting your favorite missionary or project after you’ve gone home to be with the Lord. To determine the amount of your “funding the future” gift, simply take the amount of your annual gift and multiply it by 25.

For example, if your monthly gift is $500 then your annual gift would be $6000. Multiplied by 25, this yields a total of $150,000. This would be the amount of your “bequest endowment.” You would designate the appropriate percentage of your estate that would produce this type of gift, or simply designate “what’s left” as the funding of your endowment. This gift of $150,000 with a 4% yearly distribution would then produce an annual gift of $6000, enabling you to continue supporting your favorite missionary or project. In this way, you’ve funded the future by making a gift that keeps on giving to the work that you are so passionate about—the work of Bible translation.

For more information on supporting the work of Bible translation through a will or bequest, contact us by phone at (877) 379-7131 or visit us online at WycliffeFoundation.org/wills.

Creating your Bequest Endowment

- Step-by-step:

- Calculate your annual gift

- Multiply this amount by 25

- Designate a bequest in your will or trust equal to this amount. This designation can be

- A percentage of your estate

- Specific property

- The remainder or residue (what’s left after other wishes are met)

- Here’s an example of how it works:

- Annual Gift = $6,000 Current impact

- X 25 = $150,000

- X 4% = $6,000 Future impact

- The result:

- The largest gift you’ve ever made

- Joy of laying up treasure in heaven

- Continued impact

- Encouragement for the missionary or ministry

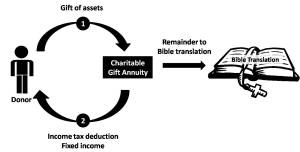

How a CGA works

The diagram below accompanies THIS article.

You can take unused or underused assets like CDs and savings accounts that are yielding low returns to fund a charitable gift annuity. The income from these assets is currently being taxed. However, establishing a Wycliffe charitable gift annuity allows a portion of the income to be tax free. The payout rate will also be considerably higher than what CDs or savings accounts currently yield.

Here’s how CGAs work:

For instance, a 90 year-old partner would receive a 9.5% rate (as of February 1, 2009). On a gift of $10,000, that would provide an annual income of $950, of which $799.90 would be tax free.

You can also use other assets such as appreciated stock or mutual funds. Using these would reduce your capital gains tax and provide you with tax-free income for life.

These are taxing times: So turn your assets into tax-free income

By Steve Davis, Director of Gift Planning, Wycliffe Foundation

In 1776 during a very difficult time in our country’s history, Thomas Paine uttered the famous phrase “These are the times that try men’s souls.” In light of all that is happening today, we could surely echo these same sentiments.

These are indeed “taxing and trying times.” Many of you are living on fixed incomes and watching some of your assets decrease in value, making it more difficult to stretch those resources and support your favorite ministries.

Here are some charitable gift annuity (CGA) ideas that will help you accomplish your goals and support the work of Bible translation at the same time, even in light of today’s uncertain times.

- Turn your income into support

If you’ve already turned your assets into tax-free income through a CGA, you may not need all of the income the annuity generates. There are two ways these funds can support Bible translation.- First, you can simply take the income you receive from your CGA and send it back to the ministry, like The Seed Company, JAARS, GIAL, or Wycliffe Bible Translators. This gift could then be designated for a particular missionary or project.

- Or you can assign your income payment to the named beneficiary of your annuity. The income from your CGA would go directly to the organization or missionary that will receive the remainder of your annuity upon your death.

- Turn your existing CGA into a current gift

This final idea allows you to take your existing CGA(s) and put them to work now.- Through a signed and dated agreement, you may transfer the contract back to Wycliffe Foundation. Some annuitants no longer need annuity payments and desire a charitable deduction. For example, you may be receiving progressively larger distributions from your IRA. Consequently, the annuity income is less important than a charitable deduction that could offset taxable distributions from the IRA. After the annuitant irrevocably assigns the annuity contract to the charity, the charity has no further obligation to make annuity payments. You receive a charitable deduction and Wycliffe uses the remainder of the contract for the work of Bible translation right now. Now you have a tool that can provide for your needs and provide for the work of Bible translation at the same time. And you can do this with certainty even in these uncertain times.

Click here to see a diagrammed real-life example of how a CGA works.

For more information on charitable gift annuities, contact us by phone at (877) 379-7131 or visit us online at WycliffeFoundation.org/cga.